japan small cap tech etf

SPDR RussellNomura Small Cap Japan ETF JSC This is the illiquid and unpopular ETF in the Japanese space with AUM of 663 million and average daily volume of just 3000 shares per day. This ETF is focused on small and medium-sized companies across Asia excluding Japan and India.

Vanguard Small Cap Etf Ranked Best Us Smid Cap Smart Beta Etfs

The largest Japan ETF is the iShares MSCI Japan ETF EWJ followed by the WisdomTree Japan Hedged Equity Fund DXJ.

. IShares MSCI Japan Small-Cap ETF The Hypothetical Growth of 10000 chart reflects a hypothetical 10000 investment and assumes reinvestment of dividends and capital gains. But the WisdomTree Japan SmallCap Dividend ETF has a different objective looking for income from smaller Japanese companies. The annual charge is quite high at 074 but this is a physical fund which inevitably raises costs for the provider.

This ETF tracks the MSCI Japan Small Cap Index which comprises smaller Japanese companies that arent included in the larger MSCI Japan index. Japan indices on small and mid caps or equity strategies Alternatively you may invest in indices on small and mid caps or equity strategies. It is pricier with a 058 charge.

Billions of dollars flooded into WisdomTrees currency-hedged flagship Japan ETF DXJ B-57 which tracks an index dominated by the large-cap exporting sector. ETF issuers who have ETFs with exposure to Japan are ranked on certain investment-related metrics including estimated revenue 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields. BOJs New Plan The BOJ entered into a new era of monetary easing which included a huge inflow of.

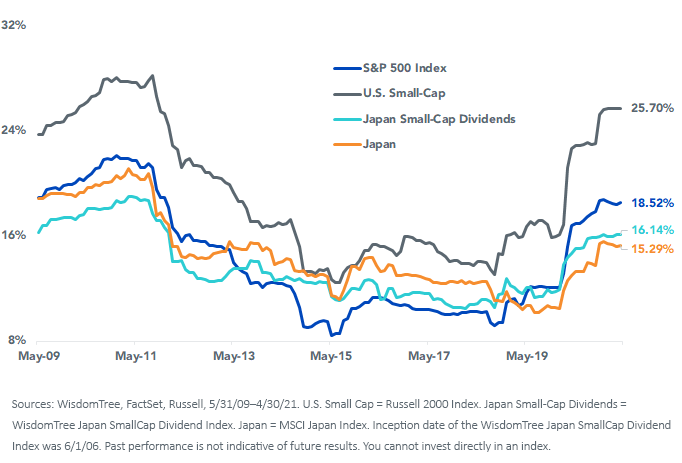

With 21 ETFs traded on the. WisdomTree Japan SmallCap Dividend Fund seeks to track the investment results of dividend-paying small-cap companies in the Japanese equity market. The performance quoted represents past performance and does not guarantee future results.

In the large-cap spectrum of funds there are many alternatives to. WisdomTree Japan SmallCap Dividend Fund. Fund expenses including management fees and other expenses were deducted.

Fund expenses including management fees and other expenses were deducted. The metric calculations are based on US-listed Japan ETFs and every Japan ETF has one issuer. Benchmark Index MSCI Japan Small Cap Index Shares Outstanding as of 05May2022 6833371 Total Expense Ratio 058 Distribution Frequency Semi-Annual Use of Income Distributing Securities Lending Return as of 31Mar2022 026 Domicile Ireland Product Structure Physical Rebalance Frequency Quarterly Methodology Optimised UCITS Yes.

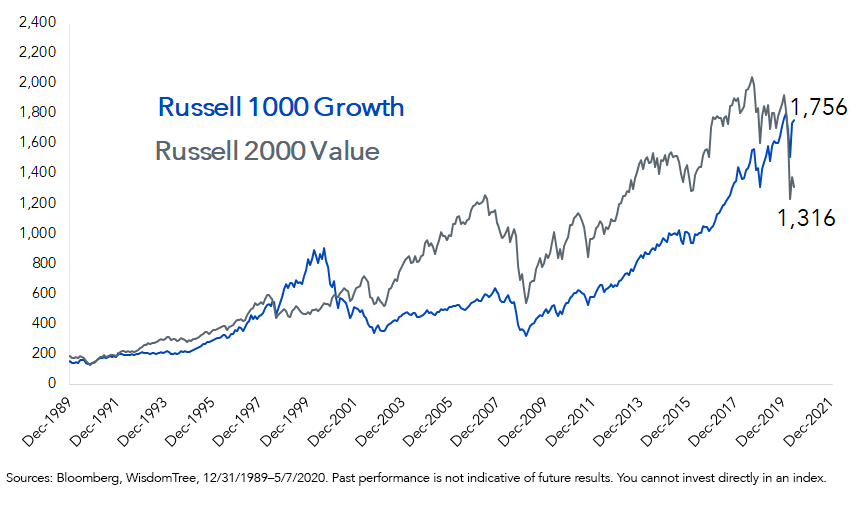

Japans social security spending is forecast to grow from 121 trillion yen in fiscal 2018 to 190 trillion yen in fiscal 2040 while GDP is expected to. IShares MSCI Japan Small-Cap ETF SCJ ETF The investment seeks to track the investment results of the MSCI Japan Small Cap Index. Value has been beaten steadily by growth since the Great.

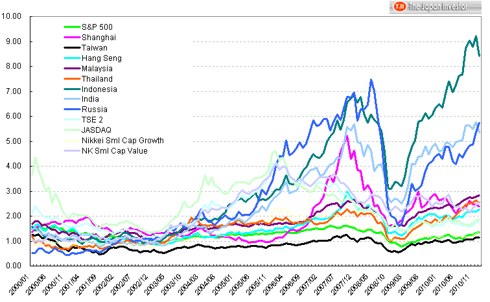

XSVM INFL and AVUV are the best small-cap ETFs for Q2 2022 By Charles Munyi Updated April 14 2022 Small-cap exchange-traded funds ETFs are designed to invest in a basket of stocks with. There are over 1100 stocks in the index and they comprise about 14 of the market cap in each country. IShares MSCI Japan Small-Cap ETF The Hypothetical Growth of 10000 chart reflects a hypothetical 10000 investment and assumes reinvestment of dividends and capital gains.

Large-cap tech growth VGT is. Focusing on sustainable growth while limiting the downside the Portfolio Managers seek companies that exhibit. Learn more about the Index that DFJ is designed to track.

Among top Japan ETFs most of the focus is on large companies. In total you can invest in 6 alternative indices on Japan tracked by 8 ETFs. Hieronder vindt u informatie over de Global X Japan Mid Small Cap Leaders ESG ETF.

The performance quoted represents past performance and does not guarantee future results. Is the top holding of the first and third of these funds while the. Overall the fund is very top-heavy with the largest 10 holdings making up more than 59 of the funds total assets.

From a universe of Japanese stocks with market capitalization in the bottom 20 the Hennessy Japan Small Cap Fund seeks companies with time-tested business models and exceptional management trading at attractive valuations. SCJ - Get iShares MSCI Japan Small-Cap ETF Report but their low trading volumes raise liquidity concerns. U kunt meer informatie vinden door naar een van de secties onderaan deze pagina te gaan zoals historische data grafieken technische analyses en anderen.

This pushed the market and stocks into bullish territory DXJ--Best ETF to Play the Japan Rally. The Vanguard Small Cap Value ETF seeks to give investors large returns by focusing on the downtrodden names in the small-cap space. The total expense ratio TER of ETFs on these alternative indices is between 010 pa.

The Japan exchange-traded funds ETFs with the best one-year trailing total returns are DXJ HEWJ and DBJP. If youre bullish on US. If youre particularly keen on getting exposure to smaller Japanese companies Id suggest that you should also consider some investment trusts as well as ETFs.

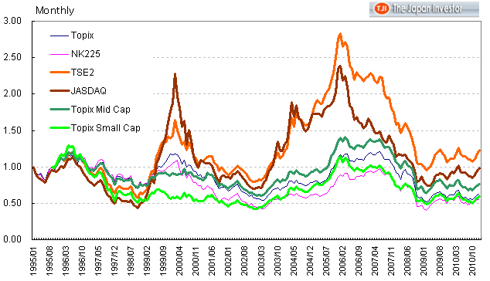

A Closer Look At Japanese Small Caps Seeking Alpha

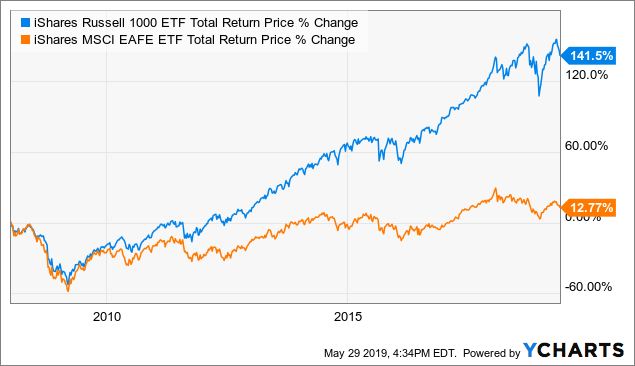

The Time May Be Right For International Small Caps Seeking Alpha

Small Cap Versus Large Cap Which Is Best

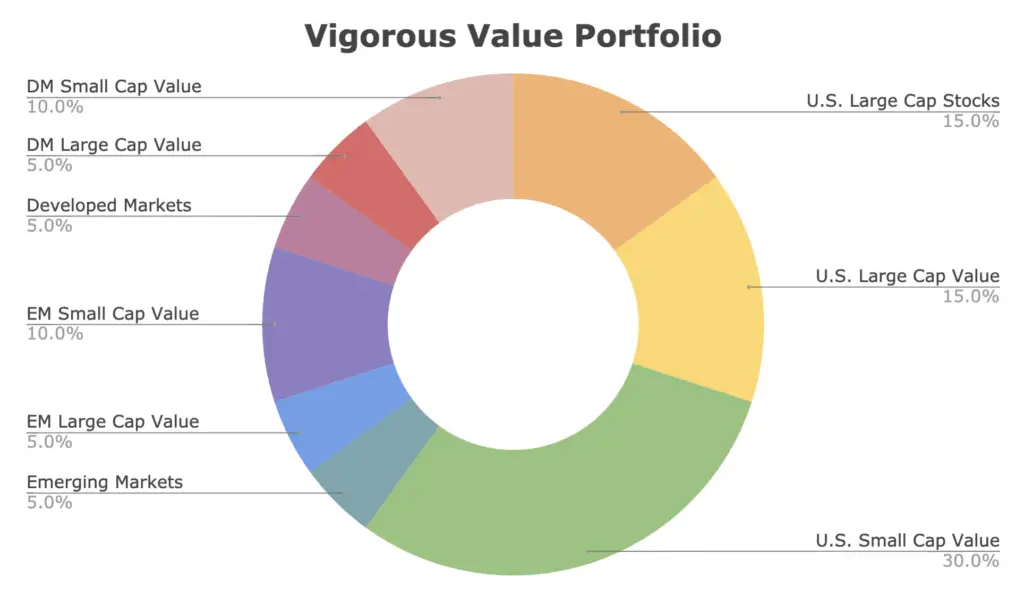

The 3 Best International Small Cap Value Etfs For 2022

The Vigorous Value Portfolio Summary And M1 Etf Pie

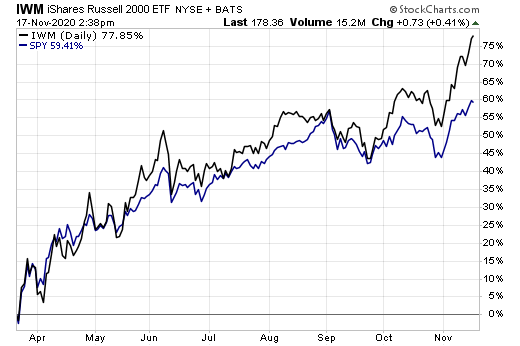

Small Cap Value Takes Leadership Over Small Growth In 2021

Why Small Cap Etfs Are Underperforming Etf Com

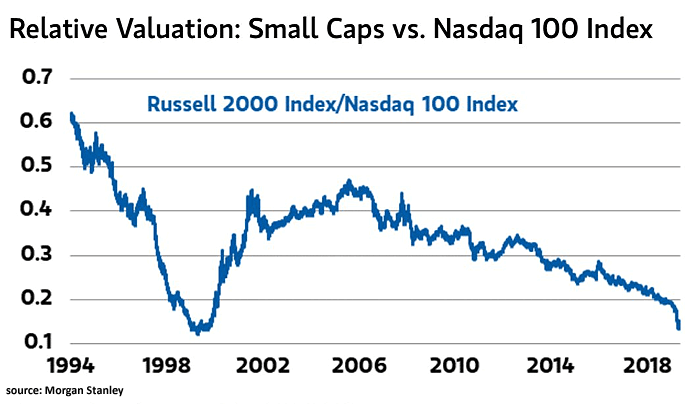

Relative Valuation Small Caps Vs Nasdaq 100 Index Isabelnet

5 Small Cap Etf Pairings Face Off

5 Small Cap Etf Pairings Face Off

In Defense Of Small Cap Value Etf Com

The Short And Long Term Case For European Small Caps Wisdomtree

The Time May Be Right For International Small Caps Seeking Alpha

A Closer Look At Japanese Small Caps Seeking Alpha

A Surprisingly Low Vol Asset Class Seeking Alpha

Vss Vanguard S Ftse All World Ex Us Small Cap Etf For Overlooked Stocks Nysearca Vss Seeking Alpha

Buy Rapid Growth Via Baillie Gifford Japanese Smaller Companies Investors Chronicle